Cumbria Food and Drink

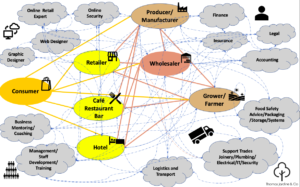

We were delighted to be asked to talk to Dr Radka Newton‘s International Masters Students about Cumbrian Food and Drink and frame the discussion around the external forces at play! When we ran our food stores, food and drink was a collection of clearly defined supply chain providers. We have watched these chains evolve into a complex, interconnected eco system. It was going to be interesting capturing this in a session with the students.

We were delighted to be asked to talk to Dr Radka Newton‘s International Masters Students about Cumbrian Food and Drink and frame the discussion around the external forces at play! When we ran our food stores, food and drink was a collection of clearly defined supply chain providers. We have watched these chains evolve into a complex, interconnected eco system. It was going to be interesting capturing this in a session with the students.

In the first few weeks of lockdown, everybody was reminded how delicate our food and drink supply chains have become . Our conversations with all parts of the food and drink eco system over the last year have highlighted the huge changes the food system has made because of COVID. Consumers and students have born witness to many of these shifts.

Making sense of the changes

Break out the PESTEL and some of those 5 forces!

Making sense of changes is made easier with business models. The two models Radka asked us to focus on were PESTEL and Porters Five Forces.

PESTEL (Political, Economic, Social, Technological, Environmental and Legal factors effecting business) hints at the directions a sector or industry might take because of changes in these factors. In normal times these factors tend to be fairly static, this is not the case for Cumbrian Food and Drink at the moment:

P – Political

- Regulatory change due to BREXIT

- Regulatory change due to COVID

- Potential regulatory change due to Independent Scotland

- More Scottish public sector support for food and drink businesses just north of Cumbria

- Borderlands

- Potential split of Cumbria Local Authority

- Loss of EU farm subsidy changes way Cumbrian Farmers find economic sustainability

E – Economic

- COVID effect on available spend…poorer spend less, richer spend more:

- Cumbrian Local areas of social deprivation spend less on food and drink

- Lake District visitors spend more on food and drink

- BREXIT decreases export/import opportunities to Europe

- Large food producers relocate to continent (McVities, Nestle?)

- Large food producers relocate to UK (Heinz moves Ketchup production back to UK in Wigan driving up demand for NW Tomatoes?)

S – Social

- Move to buy local

- More support for artisan food producers

- Cumbria small local population, potentially food and drink producers lose out to more populated areas own local food producers

- Health and moves to Vegetarian, Vegan, Gluten Free

T – Technological

- Growth of online sales

- Larger potential market place for Cumbrian Food and Drink producers

- More online competition for Cumbrian Physical Food and Drink Retailers

- Blockchain and transparency

- Online replacing High Street

- Death of local high streets , no visitors for farmers markets

- Cheaper rents and rates encourage more local food and drink to set up stores

E – Environmental

- Global warming

- Increased flooding leading to different land use (forestry v sheep)

- Changing weather giving new opportunities …Lake District Wine?

- Carbon argument re livestock cut herds of sheep and cattle

- Reduce miles in supply chain

- More support for start up local producers

- Less opportunity for growing food and drink businesses to export to other parts of UK outside of Cumbria

L – Legal

- Adoption to new regulations due to COVID, BREXIT, Carbon Footprint Targets, Scottish Independence and local regulations due to split of local authority – HUGE sectors of our supply chains becoming TEMPORARILY ILLEGAL!

All these external factors are driving change within the sector. The next tool (The Five Forces) is traditionally used on industries rather on sectors. We would argue that industries within the food and drink sector have in many cases blurred because of PESTEL and it’s an interesting exercise to try to apply the five forces to a sector. So here it goes…

The Five Forces:

Competition in the industry…..Well this got blurry! A wholesaler is no longer a wholesaler, a farmer is no longer a farmer, a producer is no longer a producer in the strictest sense…

sense…

- Small producers selling directly to consumers (Kin Vodka)

- Wholesalers producing own products (Pioneer)

- Large producers buying small producers

- Farmers diversifying and selling direct to consumers (Tailored Goat Company)

- Competition in the sector

Force 1: Potential of new entrants into the industry:

- Non meat meat products

- Dark Kitchens

- Food banks, Freegle: non cash transactions (allotments/swops/grow your own)

- Hotel and catering supply chain severely damaged by COVID

Force 2: Power of suppliers:

- Supply chain is merging vertically and horizontally (online and BREXIT farmers effect)

- Globalisation and localisation can both increase power of raw material supplier

Force 3: Power of customers:

- More focused consumer : made for you versus price sensitive, seeking transparency, ethical drive

- Shorter supply chain: consumer buying direct from food and drink producer

Force 4: Threat of substitute products:

New supply chain solutions:

- Reduction of middle man role

- Satisfying the ‘last mile’ in a rural area

- Cheap food from USA, Canada (Canadian Beef bred for UK Market advert in The Grocer)

Facing the future with confidence

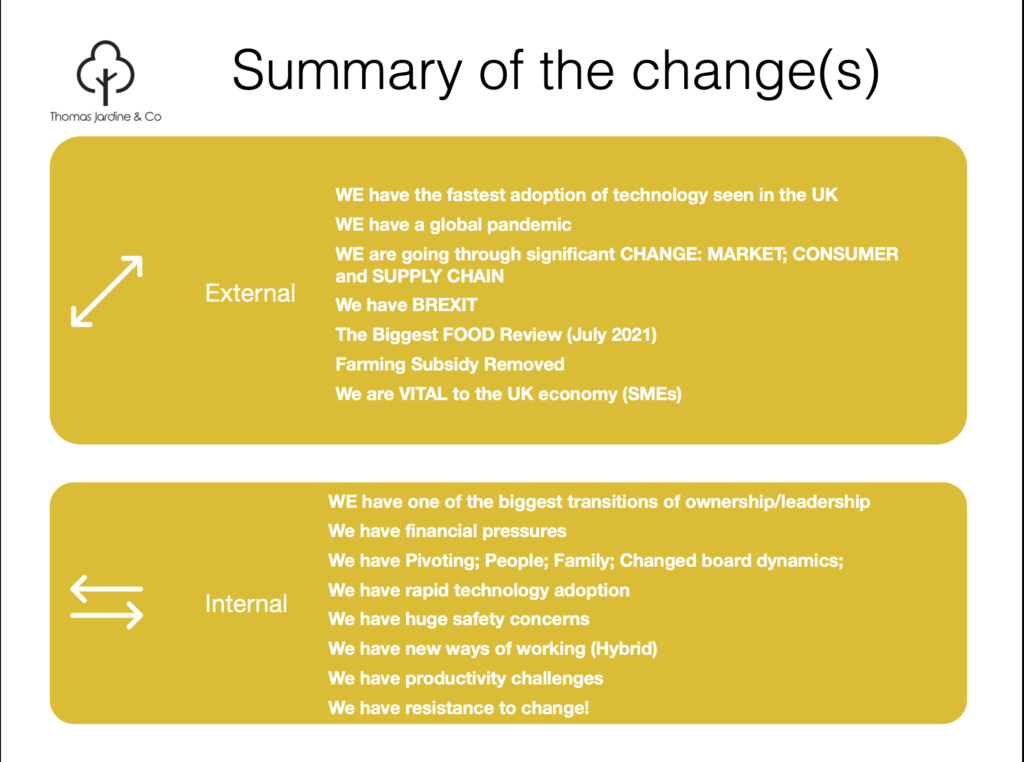

All the food and drink producers and all the other parts of the Cumbrian Food and Drink ecosystem recognise the external changes in the world we now operate in :

- WE have the fastest adoption of technology seen in the UK

- WE have a global pandemic

- WE are going through significant CHANGE: MARKET; CONSUMER and SUPPLY CHAIN

- WE have BREXIT

- The Biggest FOOD Review (July 2021) has happened and will be applied

- The current Farming Subsidy will be Removed

- WE as small businesses are VITAL to the UK economy

And we are proud to state that the sector has adapted to this world despite the fact that as businesses:

- We have one of the biggest transitions of ownership/leadership

- We have financial pressures

- We have Pivoting; People; Family; Changed board dynamics;

- We have rapid technology adoption

- We have huge safety concerns

- We have new ways of working (Hybrid)

- We have productivity challenges

- We have resistance to change!

We know how resilient and resourceful Cumbrian Food and Drink is. In July, Thomas Jardine & Co are going down to the Farm Shop & Deli Show with This is Cumbria a group of local producers to show just part of what we have to offer.

If you’re in Birmingham during the shows times come and have a chat. We are always happy to shout about the great work our food and drink sector does or to listen to how food and drink businesses are adapting and thriving to all the world has to offer…